The Center of the Insured Experience

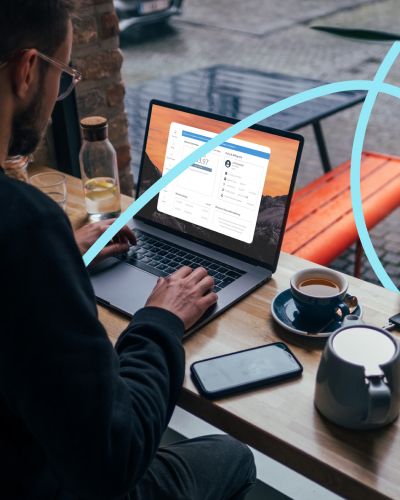

The Insured Portal is the central hub of our omnichannel experience. It's mobile optimized and multi-language, and designed to give insureds all the information they need in a single place. With the insured portal, insureds have access to detailed policy information, billing, documents, claims, and payments.

Built for mobile, the portal delivers an app-like experience without the need for downloads or updates, ensuring a fast, streamlined user experience on any device.

A Complete Solution for Policyholder Needs

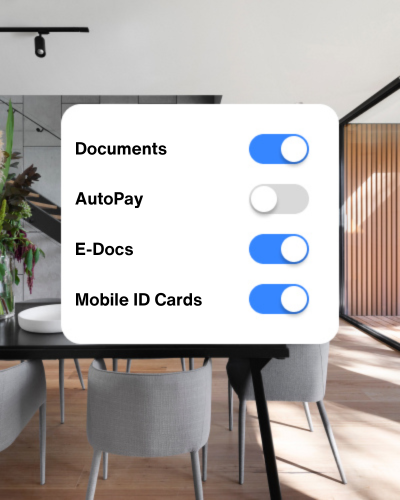

The Insured Portal provides a centralized hub for all policyholder resources. Billing, documents, policy information, and claims updates are all available in an intuitive, easy to navigate interface. Real-time data synchronization provides accuracy across channels. Features like mobile ID cards, automatic payments, and personalized alerts ensure that insureds have everything they need right at their fingertips.

A Complete, Configurable Solution

Designed specifically for the insurance industry, the Insured Portal is configurable to support a wide range of workflows. Each component can be easily configured, no code required, allowing insurers to create a customer experience that’s unique to their brand and meets their policyholders' specific expectations. Multi-language support further extends the portal’s reach, ensuring a welcoming experience for a diverse customer base.

Self-Service with Advanced Security

The Insured Portal is built to deliver self-service access without compromising security. With modern password enforcement, multi-factor authentication (MFA), and magic-link logins, it keeps policyholder data safe while ensuring smooth access to accounts. Our platform is SOC 2 and PCI compliant, and employs industry-leading security protocols to maintain the highest levels of protection.

A Portal That Grows with Your Needs

The Insured Portal is designed for more than just convenience; it’s a fully optimized, evolving solution that enhances customer engagement. By leveraging user insights and behavioral data, insured.io continuously refines the portal’s features, delivering regular updates that align with policyholder needs and industry best practices. This commitment to ongoing improvement and innovation keeps the Insured Portal responsive, intuitive, and ready to exceed modern expectations, driving loyalty and creating a meaningful experience from the first interaction to the last.

Ready to see the future of insurance customer experience?