Complete Omnichannel Platform for Insurance Engagement

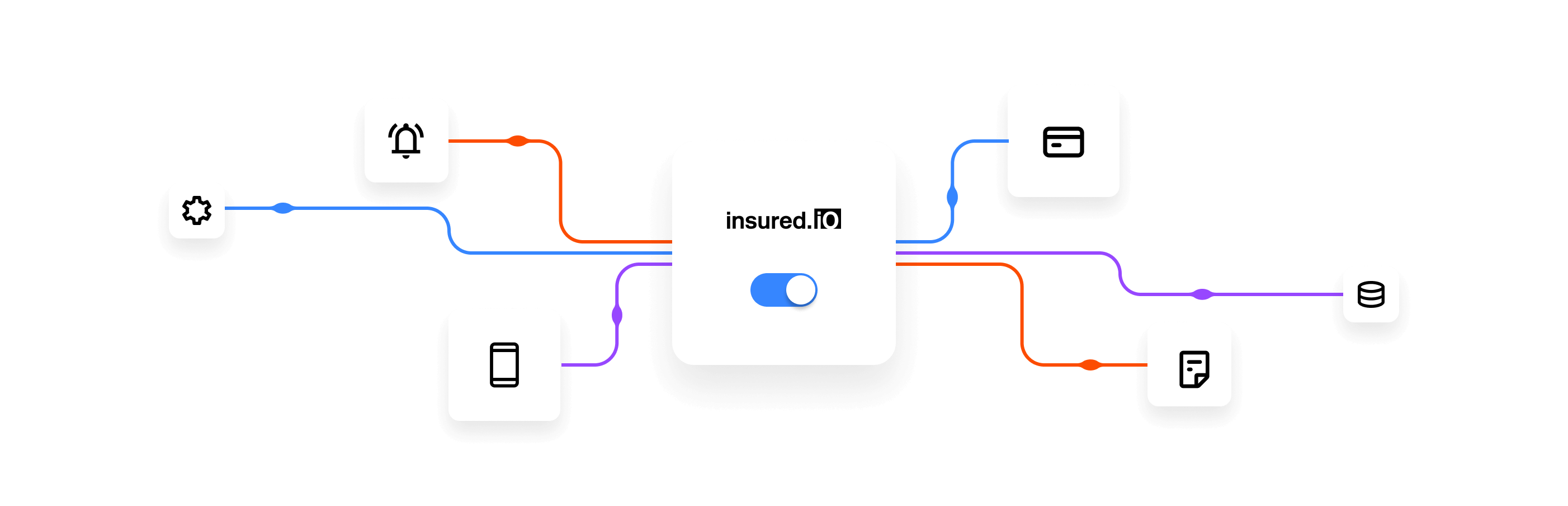

The insured.io platform brings every aspect of customer interaction into one seamless platform. Designed for insurers seeking to deliver a premium experience, our platform combines omnichannel accessibility, configurability, and ease of use, putting policyholders in control of their insurance. From policy information to payments, claims updates, and proactive notifications, insured.io empowers insurers to engage policyholders effortlessly on their preferred channels, boosting satisfaction and loyalty.

insured.io gives insurers a competitive edge through real-time, integrated touchpoints that meet today's expectations for convenient and personalized self service, driving engagement across mobile, desktop, and IVR channels. By supporting a seamless experience at every step, our platform doesn’t just streamline processes — it transforms the way your policyholders connect with their insurance.

Why Omnichannel Experience Is Essential

In today’s market, insurers must deliver more than just convenience—they must offer a seamless, customer-centric experience that meets modern expectations. Research shows that policyholders using multiple self-service channels have a 25% higher retention rate, and nearly 60% would switch carriers for real-time updates on policies and claims. Our platform meets this demand by giving insurers the tools to proactively engage policyholders, reduce customer effort, and improve satisfaction across every interaction.

No dedicated tech team needed

Cloud native and API driven

Fully system independent

Our Platform Delivers

The insured.io platform unifies the entire customer journey, allowing policyholders to access all aspects of their insurance experience across web, mobile, and over the phone. With instant data synchronization across channels, insured.io ensures that every customer touchpoint is accurate, up-to-date, and consistent. Whether they need to make a payment via IVR, a detailed document on the portal, or sign up for SMS alerts, the insured.io platform provides everything they need in one powerful, user-friendly environment.

Configurability, Flexibility, and Speed

Unlike traditional systems, the insured.io platform is built to be as flexible as it is powerful. Designed for mid-sized insurers, it requires no additional hardware or specialized technical staff, making it easy and affordable to maintain. The platform is highly configurable, allowing insurers to personalize workflows, notifications, and content to fit each policyholder’s needs. Plus, with quick implementation time, insurers can go live in as little as 60-90 days, thanks to our pre-built integrations and out-of-the-box features.

Seamless Omnichannel Integration

Built for a Diverse Customer Base: Multi-Language, Mobile-Optimized, and Accessible

The insured.io platform’s multi-language support, mobile-first design, and progressive web app (PWA) technology offer insurers a global reach and app-like experience without the need for an app store. This mobile-friendly approach ensures all users can access their policies seamlessly on any device. Additionally, the platform’s flexibility allows insurers to serve diverse demographics effectively, from tech-savvy Millennials to those who prefer traditional channels like IVR and CSR support.

Drive Engagement with Real-Time Insights

With insured.io’s built-in Insights and optional Insights Pro upgrade, insurers gain actionable data on policyholder engagement across all channels. Real-time metrics and detailed reports provide visibility into usage patterns, helping carriers understand customer behaviors and refine strategies to improve service. For CSRs, Insights Pro delivers detailed engagement histories, helping them provide quick, tailored responses that foster trust and strengthen relationships.

Security and Peace of Mind

Our platform is PCI-Compliant and securely hosted in geo-replicated data centers across the U.S. All data is fully encrypted, and sensitive information is never stored. Standard 2-factor authentication ensures only the right people get access to the platform.

See How Our Platform Transforms Insured Engagement